S&P 500 Surge: Market Soars 2.7% Amid Positive Developments

Last week marked a thrilling turnaround for the S&P 500, which gained an impressive 2.7%. This surge comes on the heels of a challenging period after the US reported a minor GDP shrinkage, which had dampened market sentiment. However, a combination of strong job data, a US-Ukraine resource deal, a pause in escalating trade war tensions, and robust corporate earnings fueled a recovery. Additionally, gradual progress in Ukraine-Russia peace efforts contributed to the optimistic mood. Let’s dive into the details of this thrilling week, highlighting the top gainers, notable losers, and what this means for investors.

- The S&P 500 rose 2.7%, driven by positive economic indicators and geopolitical developments.

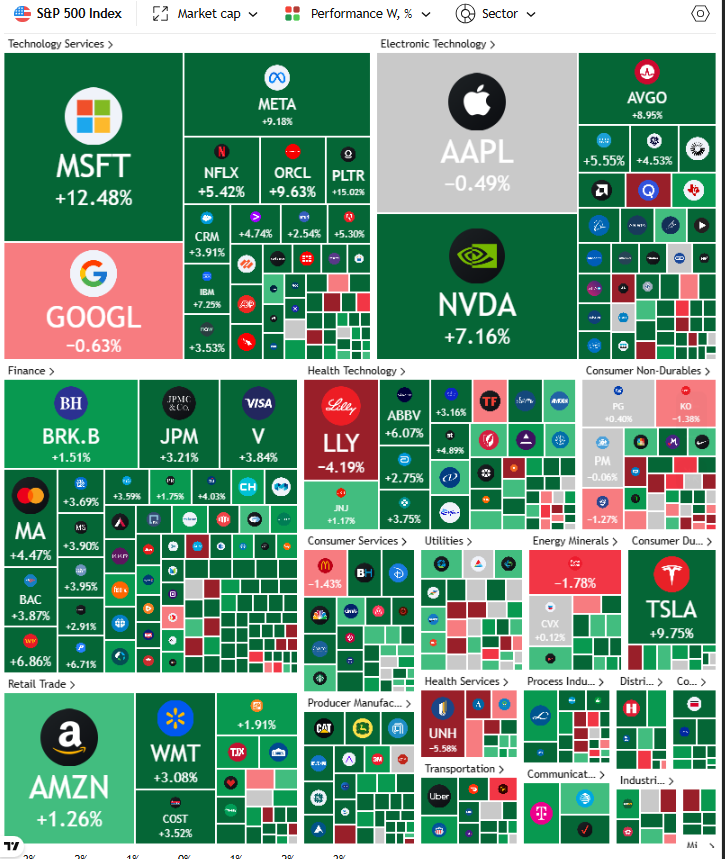

- Tech giants led the gains, with Microsoft (MSFT) up 12.48%, Meta (META) rising 9.18%, and NVIDIA (NVDA) gaining 7.16%.

- Losers included Eli Lilly (LLY), down 4%, and UnitedHealth (UNH), which fell 6%.

Markets Gain : Economic and Geopolitical Factors

The S&P 500’s 2.7% gain last week was nothing short of thrilling for investors. Strong job data provided a much-needed signal of economic resilience, countering fears sparked by the recent GDP shrinkage. The US-Ukraine resource deal further bolstered confidence, as it hinted at stabilizing global supply chains and energy markets. Additionally, a pause in the escalation of trade war hostilities offered a reprieve, allowing markets to focus on growth rather than uncertainty. These factors, combined with incremental progress in Ukraine-Russia peace talks, created a fertile ground for market recovery, making this a thrilling week for Wall Street.

Corporate earnings also played a significant role in this rally. Many S&P 500 companies posted better-than-expected results, restoring investor confidence. The tech sector, in particular, shone brightly, with several heavyweights driving the index higher. This thrilling confluence of events underscores the market’s ability to rebound when supported by positive fundamentals and geopolitical stability.

Tech Sector Leading The Markets

The tech sector was at the forefront of this thrilling rally, with several companies posting significant gains. Microsoft (MSFT) led the pack with a remarkable 12.48% increase, likely fueled by strong cloud computing performance and optimism around its AI initiatives. Meta (META) followed closely, gaining 9.18%, as investors responded positively to its focus on virtual reality and advertising growth. NVIDIA (NVDA) also contributed to the thrilling tech performance, rising 7.16%, driven by continued demand for its AI and gaming chips. Other notable gainers included Oracle (ORCL), up 9.6%, and Netflix (NFLX), which rose 5.4%, reflecting resilience in the streaming sector. These gains highlight the tech sector’s pivotal role in the S&P 500’s thrilling recovery.

Markets Challenges Amid the Rally

Despite the overall thrilling performance, not all companies shared in the gains. Eli Lilly (LLY) saw a 4% decline, possibly due to concerns over drug pricing pressures or regulatory challenges in the healthcare sector. UnitedHealth (UNH) faced an even steeper drop, falling 6%, which could reflect broader investor worries about rising healthcare costs or policy shifts. These losses, while notable, were overshadowed by the broader market’s upward momentum, but they serve as a reminder that even in a thrilling week, certain sectors face headwinds.

What This Week Means for Investors

The S&P 500’s thrilling 2.7% surge signals a potential turning point for the market. The combination of strong economic data, easing geopolitical tensions, and solid corporate earnings has restored investor confidence, at least for now. Tech stocks, with their impressive gains, remain a key area of opportunity, but investors should also be mindful of vulnerabilities in sectors like healthcare, as evidenced by the declines in Eli Lilly and UnitedHealth.

Looking ahead, the market’s trajectory will likely depend on continued progress in peace talks, sustained economic growth, and upcoming earnings reports. For now, this thrilling week offers a moment of optimism, but investors should remain vigilant and diversified to navigate any future volatility. The S&P 500’s performance underscores the importance of staying informed and adaptable in a dynamic market environment.

For the latest news, stay tuned to Globalfinserve.com.

Watch Latest Business Videos

Latest Market Trends