As we move further into 2024, global commodities have seen a strong performance across multiple sectors, despite some challenges in key agricultural markets. Gold has led the charge with stellar gains, but coffee and cocoa have emerged as top performers, much to the dismay of chocolate lovers and coffee drinkers hoping for more affordable prices. In addition to agricultural commodities, oil prices have seen upward pressure due to tight supply conditions, especially with crude oil stockpiles at the U.S.’s largest storage hub at their lowest seasonal levels since 2007.

Commodities Index: A Solid Year with Notable Gains

The Bloomberg Commodity Spot Index, which tracks the performance of 24 major energy, metal, and agricultural contracts, saw a 6.3% increase in 2024, marking a reversal from the losses seen in 2023. While the rally in gold futures played a key role in lifting the overall index, the performance was also tempered by significant price declines in major agricultural crops like wheat, corn, and soybeans. The rise in gold prices, which has been one of the standout performances, has helped to buoy the index despite the pressure from other commodities.

Despite a broadly positive performance for commodities, the index’s results remained closer to the average for the year, showing that while some sectors have experienced incredible growth, others have struggled. In particular, agricultural commodities have had mixed performances, impacting the broader index.

Oil: Supply Tightness Pushes Prices Higher

In the oil sector, U.S. crude inventories saw a significant drawdown of 1 million barrels during the last full week of 2024. Stockpiles at Cushing, Oklahoma, a vital storage hub, fell to the lowest seasonal levels since 2007, exacerbating the supply constraints and pushing up the premium on West Texas Intermediate (WTI) futures contracts. This tightening of the supply chain has caused the “prompt spread” — the difference between the near-term and longer-term futures contracts — to rise to its highest point in three months, signaling that traders are anticipating further price increases in the near term.

The reduction in oil inventories is a result of both OPEC+ supply controls and increased global demand. While geopolitical factors and unpredictable supply shocks also play a role, the supply-demand dynamics in the oil market remain highly volatile, and analysts are predicting that the current tightness will continue to support prices in the short term.

Coffee and Cocoa: Prices Soar as Demand Continues to Outpace Supply

Coffee and cocoa have emerged as some of the biggest winners in the commodity space this year, with both experiencing impressive rallies. Coffee, particularly the arabica variety favored by major coffee chains such as Starbucks, has seen prices soar due to several factors, including adverse weather conditions in key producing countries and rising production costs. As a result, major coffee producers have been exploring price hikes to mitigate the surge in the cost of beans, which could lead to higher prices for consumers in the coming months.

The cocoa market has been equally bullish, with prices climbing to new highs. Chocolate lovers have already felt the impact of rising cocoa prices, with candy bars becoming more expensive and smaller in size. As demand for premium chocolate products continues to rise globally, the upward trend in cocoa prices is expected to persist into 2025, further driving up costs for manufacturers and consumers alike.

Gold: Investors Navigate Shifting Market Conditions

While gold has long been seen as a safe-haven asset, 2024 has brought some volatility to the precious metal. The year started with strong optimism regarding potential interest rate cuts by the Federal Reserve, which boosted gold prices and ETF holdings. However, following the U.S. presidential election in November, the gold market faced renewed challenges as the stronger U.S. dollar undercut some of the momentum gold had gained earlier in the year.

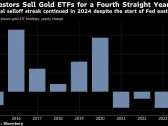

Gold-backed exchange-traded funds (ETFs) saw their holdings decline by 3.2% in 2024, marking the fourth consecutive year of outflows. This sell-off can be attributed to several factors, including the renewed strength of the dollar and a shift in investor preferences towards equities and cryptocurrencies like Bitcoin, which have gained in popularity during times of market uncertainty.

While spot gold prices have fluctuated, the overall sentiment surrounding the precious metal remains cautiously optimistic. Analysts are keeping a close eye on future Fed actions, particularly regarding interest rate policy, as this could significantly impact gold prices going forward.

Key Takeaways from 2024’s Commodity Markets

- Strong Performance in Soft Commodities: Coffee and cocoa have emerged as standout performers, benefiting from strong demand and production challenges. This surge has led to higher prices for both, with impacts being felt by consumers worldwide.

- Oil Market Tightness: The decline in U.S. crude inventories, particularly at Cushing, Oklahoma, has led to higher prices in the oil sector. A tighter supply outlook is expected to continue to drive oil price increases, at least in the short term.

- Gold Volatility: While gold saw initial gains in 2024, the renewed strength of the U.S. dollar post-election has dampened some of its momentum. Despite this, gold remains a key asset for many investors, particularly in times of economic uncertainty.

- Mixed Agricultural Performance: While agricultural commodities such as wheat, corn, and soybeans faced price declines, other segments, including soft commodities, experienced significant gains. The broader agricultural sector remains volatile, with weather patterns playing a significant role in driving prices.

- Global Supply and Demand Dynamics: Global supply and demand forces are continuing to shape commodity prices across various sectors. Supply chain disruptions, weather conditions, and geopolitical events remain key factors that can significantly influence the trajectory of commodity prices.

Conclusion: Navigating Commodities in 2024

The first quarter of 2024 has seen strong performances in key commodities, with coffee, cocoa, and gold leading the charge. While there are ongoing challenges in agricultural markets and some volatility in the precious metals space, the overall outlook remains positive for many raw materials. As global supply and demand forces continue to evolve, the next few months will be crucial in determining the sustainability of these price trends.

For the latest Business and Finance News, subscribe to Globalfinserve, Click here.

#NYSE #USMARKETS #DOW #SP500 #NASDAQ #Economy #Finance #Business #Global #Earnings #CEO #CFO #Analysis #AI #Tech